Your Ultimate Guide To Saving Money

Learn how to build lasting habits, choose the best savings accounts, and grow your money with confidence

Saving money isn’t just about cutting back it’s about planning for freedom. When you start saving, you give yourself options: the ability to handle emergencies, make big purchases, or prepare for retirement without stress. Whether you’re saving for your first apartment, a new car, or a safety cushion, this guide will help you start strong and stay consistent.

Why saving matters

Saving money is one of the most important habits you can develop. It gives you peace of mind and helps you stay financially independent. Here’s why it matters:

- Builds financial security.

- Helps you avoid unnecessary debt.

- Opens doors for future investments.

- Reduces stress during emergencies.

- Gives you flexibility for life’s surprises.

Types of Saving accounts

Traditional Savings Account

These are the most common. They’re great for short-term saving and keeping your money easily accessible, though interest rates are usually lower.

High Yield Savings Account (HYSA)

.

Offered mostly by online banks, these accounts give you a higher return on your savings. They’re great for emergency funds or medium-term goals.

Certificates of Deposit (CDs)

CDs lock your money for a set period (like 6 months or 1 year) in exchange for higher interest. They’re best when you don’t need immediate access to your funds.

Money Market Account (MMA)

These accounts often require a higher balance but can earn better interest rates. They also allow limited check-writing or debit access.

How to build a strong savings plan

Creating a savings plan doesn’t need to be complicated. Follow these five steps to get started:

Step 1: Set a Clear Goal.

Decide what you’re saving for—emergencies, college, travel, or a car.

Step 2: Automate Your Savings.

Set up automatic transfers from your checking account so you don’t have to think about it.

Step 3: Track Your Progress.

Use apps or a spreadsheet to monitor your growth. Seeing your balance rise keeps you motivated.

Step 4: Cut Small Expenses.

Cancel unused subscriptions, make coffee at home, or pack lunch a few days a week.

Step 5: Increase Savings Over Time.

As your income grows, raise your contribution little by little.

Recommended Saving Platforms

Recommended Calculators

How Much Should I Save?

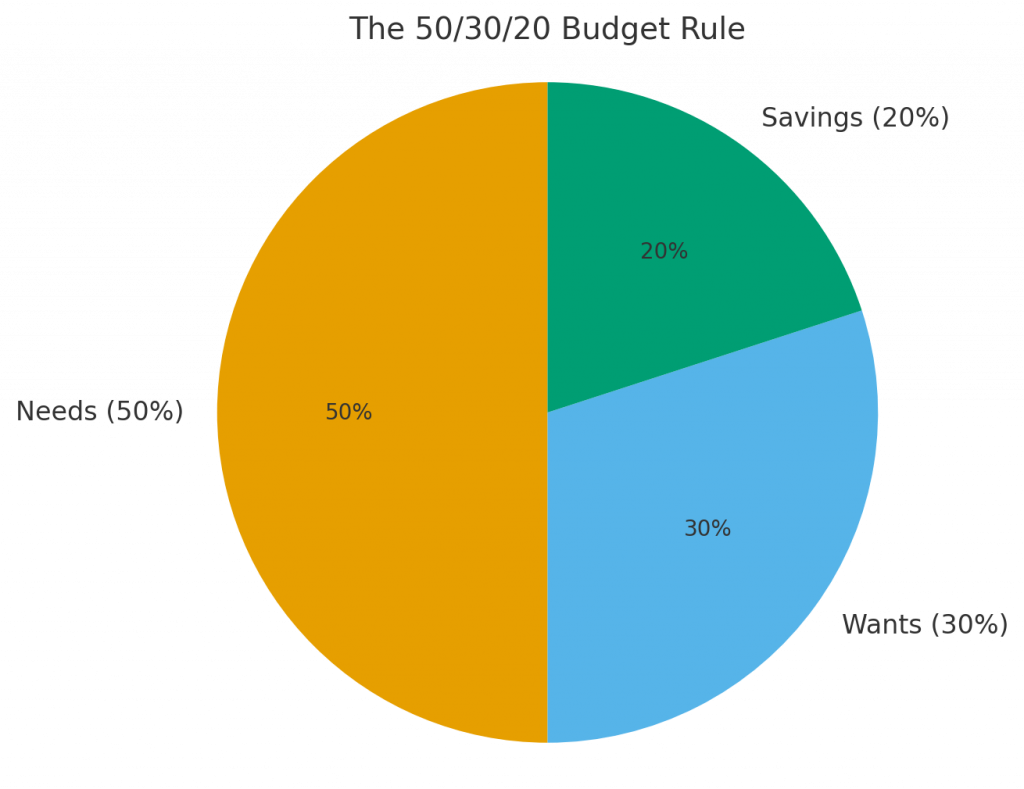

A simple rule to follow is the 50/30/20 Rule:

50% → Needs (rent, groceries, bills)

30% → Wants (entertainment, dining out)

20% → Savings (emergency fund, investments)

Smart Tips to Save More

Use cashback apps and browser extensions.

Why it works:

Cashback apps partner with retailers and share a portion of their commission with you, effectively giving you discounts on purchases you already planned to make. Bankrate+2Investopedia+2

Because many everyday purchases (groceries, gas, online shopping) are eligible, these savings compound over time. Bankrate+2OneMoneyWay+2

Some apps also include coupon scanning, price comparison, or alerts, further enhancing your deal-finding. Bankrate

Caveats / tips:

Be wary of delays in payouts or minimum withdrawal thresholds. Consumer NZ+1

Don’t overspend just to chase cashback — only use it for purchases you needed anyway.

Always read privacy policies (some apps may collect data).

Resources you can link to:

Bankrate’s guide: How Do Cash Back Sites Work? Bankrate

Investopedia’s explanation of cashback & rewards programs Investopedia

Consumer.org.nz: pros & cons of cashback websites Consumer NZ

Cook more meals at home

Why it Works:

A study found that home-cooked meals were associated with lower food spending and fewer calories from unhealthy sources, compared to eating out. PMC+1

Research from Washington’s School of Public Health showed that people who cooked at home had diets lower in sugar and fat, and the cost didn’t necessarily increase just because food was healthier. School of Public Health

Articles estimate that restaurant or delivery meals can be 3–5 times more expensive than preparing the same meals at home. Real Plans+29 News+2

A nutrition/cancer-prevention oriented organization points out that people cooking dinner at home saved about $2/day on food, versus eating out. American Institute for Cancer Research

Caveats / tips:

Time is a factor — start with simple recipes.

Meal prep in bulk to reduce daily effort.

Use seasonal or discounted ingredients.

Resources you can link to:

UW / Washington public health on home cooking costs & diet School of Public Health

AICR (cancer prevention org) on how cooking at home saves money & improves diet American Institute for Cancer Research

Forbes / meal delivery cost comparisons Real Plans

Schedule “no-spend” weekends

Why it works:

A no-spend weekend forces mindfulness: instead of automatic or impulsive spending, you rely only on what you already have.

It helps break the habit of small purchases (coffee, takeaway, impulse buys) which often add up.

Psychologically, such “challenges” reset spending habits and can give you awareness of how often you spend without thinking.

Research / resources to support:

While direct academic studies on “no-spend weekends” are limited, personal finance experts often cite behavioral psychology principles (habits, impulse control) as backing for this technique (e.g. “spending fasts” or “money challenges”).

Many finance blogs and experts include “no-spend periods” among their top budgeting tips (e.g., see “10 Budget-Friendly Tips” from Investopedia) Investopedia

Resources you can link to:

Investopedia: 10 Budget-Friendly Tips (mentions cutting subscription, mindful spending) Investopedia

Behavioral finance or personal finance blogs (you can search by “no-spend challenge personal finance”)

Use your library instead of buying books

Why it works:

Public libraries offer books, ebooks, audiobooks, magazines, etc., often for free with a library card. That eliminates the need to purchase items you might only read once. The Week+1

Many libraries now have “Library of Things” collections: tools, appliances, musical instruments, games, and more you can borrow instead of buying. Payactiv

Borrowing rather than buying reduces clutter and repetitive spending.

Library collections are tax-supported — essentially, you’ve already paid (via taxes) for access; using them maximizes value. ournextlife.com+1

Resources you can link to:

The Week: “6 ways your local library can save you money” The Week

Payactiv’s article: using library services beyond books Payactiv

MrMoneyMustache on “Get Rich With: Your Local Public Library” Mr. Money Mustache

Review subscriptions every month

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

FAQ

How much should I have saved by 25?

A good rule of thumb is to save about 50% of your annual income by age 30—but the key is to just start, no matter your age.

What’s the safest type of savings account?

FDIC-insured savings accounts or CDs from reputable banks are very safe.

Should I pay off debt or save first?

If your debt has high interest (like credit cards), pay that down first. Otherwise, try saving and paying debt simultaneously.

Are online banks safe?

Yes, as long as they’re FDIC-insured. Always verify the bank before opening an account.